Editable Promissory Note Template [PDF & Word]

Create a Promissory Note template with ease with LegalSimpli. Secure your rights, streamline processes, and maximize your revenue efficiently.

Feel Safe with LegalSimpli

100% Secure

Enjoy peace of mind because LegalSimpli ensures all customer data is 100% secure.

Unlimited Cloud Storage

Keep your legal files secure and always accesible with LegalSimpli's unlimited document storage.

Customer Support

Experience top-tier costumer support with LegalSimpli, where your statisfaction is our top priority.

Promissory Note Overview

A Promissory Note outlines the terms and conditions of a loan agreement between two parties. The document defines important characteristics of the transaction, details such as the names of the borrower and lender, the amount of money being borrowed, the interest rate, the repayment schedule, and any other relevant information. As a borrower or lender, it is essential to have a Promissory Note Agreement in place to ensure that both parties are aware of their obligations and rights.

A solid Promissory Note will help clear up essential questions between both parties, like if there is collateral to put up and how long the borrower has to pay back their debts. Taking the time to draft one at the beginning of an agreement might save you time and money in the long run by guaranteeing that both parties fully understand the agreement.

Key Takeaways:

- A Promissory Note is a legal document used to record the terms and conditions of a loan agreement between two parties.

- You need a Promissory Note when you lend or borrow money, especially in situations where there is no collateral involved.

- The components of a Promissory Note typically include the names of the borrower and lender, the loan amount, interest rate, repayment terms, and any penalties for default.

Your Stories, Our Commitment

How our templates are helping users streamline legal matters

What is a Promissory Note?

When Do I Need a Promissory Note?

- When loaning money to family or friends: Even when you trust someone, it’s always a good idea to have a written agreement in place. A Promissory Note can help clarify the loan terms and prevent misunderstandings.

- When borrowing or lending a significant amount of money: If you’re borrowing or lending a large sum, it’s important to have a legal agreement to protect both parties. A Promissory Note can ensure that the borrower makes payments on time and that the lender is repaid according to the agreed-upon terms.

- When applying for a student loan: You are often expected to sign A Student Loan Promissory Note, or a Master Promissory Note when borrowing money from the federal government to pay for school.

- When buying a home: a Promissory Note can outline the repayment schedule, interest rate, and consequences of defaulting on the loan when signing up for a mortgage.

How To Fill Out a Promissory Note Using Our FREE Wizard Template?

Simplify the process of completing a Promissory Note form

- 1Select your preferred format and color.

- 2Fill in the required information.

- 3Add or request electronic signatures.

- 4Download, print, or send your customized legal document.

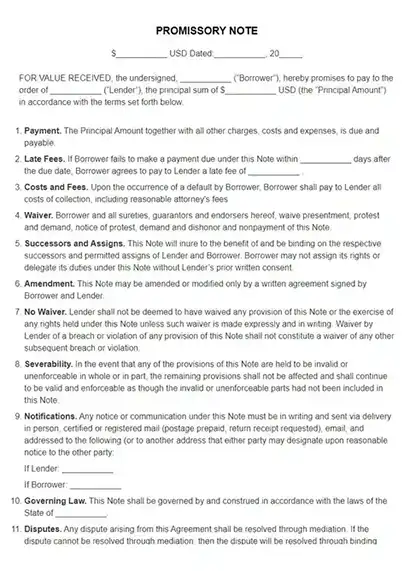

Components of a Promissory Note

- The names of the borrower and lender

- The date the Promissory Note was created

- The amount of money borrowed

- The interest rate (if applicable)

- The repayment terms, including the payment schedule and due dates

- Any late fees or penalties for missed payments

- Any collateral or security for the loan (if applicable)

- Signatures of both the borrower and lender

What are the Advantages of using a Promissory Note fillable template?

Consequences of not Having an Promissory Note

Short on Time?

Read the Highlights:

Notarization provides legal protection if dispute over loan/repayment.